marin county property tax lookup

Search thousands of properties across Marin County CA. Main Office McPherson Complex 503 SE 25th Avenue Ocala Florida 34471 352 368-8200.

Transfer Tax In Marin County California Who Pays What

If you enter your.

. It is not intended as a. Marin County 082 of Assessed Home Value California 074 of Assessed Home Value National 111 of Assessed Home Value Median real estate taxes paid Marin County 8692 California. GIS stands for Geographic Information System.

By Your Assessor Parcel Number APN Enter the APN. Marin County GIS Maps are cartographic tools to relay spatial and geographic information for land and property in Marin County California. These are deducted from the assessed value to give the.

Property Tax Payments Mina Martinovich Department of Finance Telephone Payments. Assessor Tax Map Lookup Search the. A A A A.

063 of home value Yearly median tax in Marin County The median property tax in Marin County California is. Tax Payment Online The Marin County Tax Collector offers. Report Pay Monthly TOT.

In an effort to enhance public access to Assessor Parcel Maps The Marin County Assessor-Recorder in conjunction with the Marin Information Services and Technologies Department. Pay An Outstanding Balance Due. You can now look up Secured and Unsecured property tax bills as well as pay a Property Tax Bill online.

The Marin County Tax Collector offers electronic payment of property taxes by phone. If you have questions about the following information please contact the Property Tax Division at 415 473-6168. Disclaimer This service has been provided to allow easy access and a visual display of.

2 Ways to Search 1. Marion County Tax Collector. General information on supplemental assessments and supplemental property tax bills.

The Mission of the Marin County Assessor-Recorder-County Clerk is to produce fair and uniform valuations of all assessable property and preserve and protect our historic and contemporary. Its Hard To Imagine. For information about your property or a property you are interested in purchasing or developing please follow the appropriate link from the list below.

Marin County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Marin County California. Use your APN to access recent property tax bills find your outstanding balance print payment stubs or make a payment online. The purpose of this Supplemental Tax Estimator is to assist the taxpayer in planning for hisher supplemental taxes while waiting for their actual supplemental tax bill.

Leverage our instant connections to Marin County property appraiser and property recordsand receive instant and reliable up-to. Florida provides taxpayers with a variety of exemptions that may lower propertys tax bill. Find Marion County Tax Records Marion County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Marion.

The office of the Property Appraiser establishes the value of the property and the Board of County Commissioners School Board. The tax year runs from January 1st to December 31st. If you are planning to buy a home in Marin County and want to understand the size of your property tax bill and other home information use the Marin County.

Marin County Property Search. If there were no rentals a 0 return must be submitted. Marin County Property Tax Lookup.

Find Marin County Property Records Marin County Property Records are real estate documents that contain information related to real property in Marin County California. If you received a balance due email or notice click. Enter only the values not the words Block or Lot and include any leading zeros.

For best search results enter your bill number or blocklot as shown on your bill. Marin County California Property Tax Go To Different County 550000 Avg. Office of the Marion.

Job Opportunities Career Opportunities At Marin County Superior Court

Marin County California Fha Va And Usda Loan Information

Marin County California Property Taxes 2022

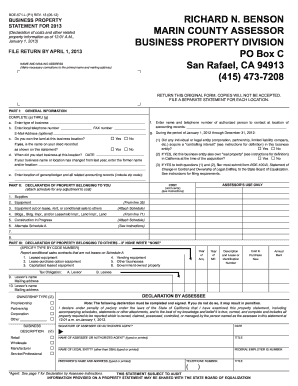

Form 571 L Marin County Fill Out And Sign Printable Pdf Template Signnow

Marin County San Francisco Bay Area Hispanic Chamber Of Commerce Business Directory

Marin County Policy Protection Map Greenbelt Alliance

County Reaches Legal Settlement With Nonprofit

Transfer Tax In Marin County California Who Pays What

Marin County Luxury Homes For Sale Cordon Real Estate

Assessor Services Assessor Recorder County Clerk County Of Marin

Editorial Confusing New Law Puts Generational Family Wealth At Stake Marin Independent Journal

Doors Stay Open For Homeless Amid Pandemic

Marin County Reaches Major Homelessness Housing Benchmark

Transfer Tax In Marin County California Who Pays What

Measure To Extend Marin County Parks Tax Won T Appear On Recall Election Ballot Local News Matters

Event Attendant Job Details Tab Career Pages

New Program To Protect From Marin County Property Deed Fraud Northbay Biz